Income from the property: The rent received or receivable by a person for a tax year, other than rent exempt from tax under this Ordinance, shall be chargeable to tax in that year under the head “Income from Property”.

Rent: It means any amount received or receivable by the owner of land or a building as consideration for the use or occupation of, or the right to use or occupy, the land or building, and includes any forfeited deposit paid under a contract for the sale of land or a building.

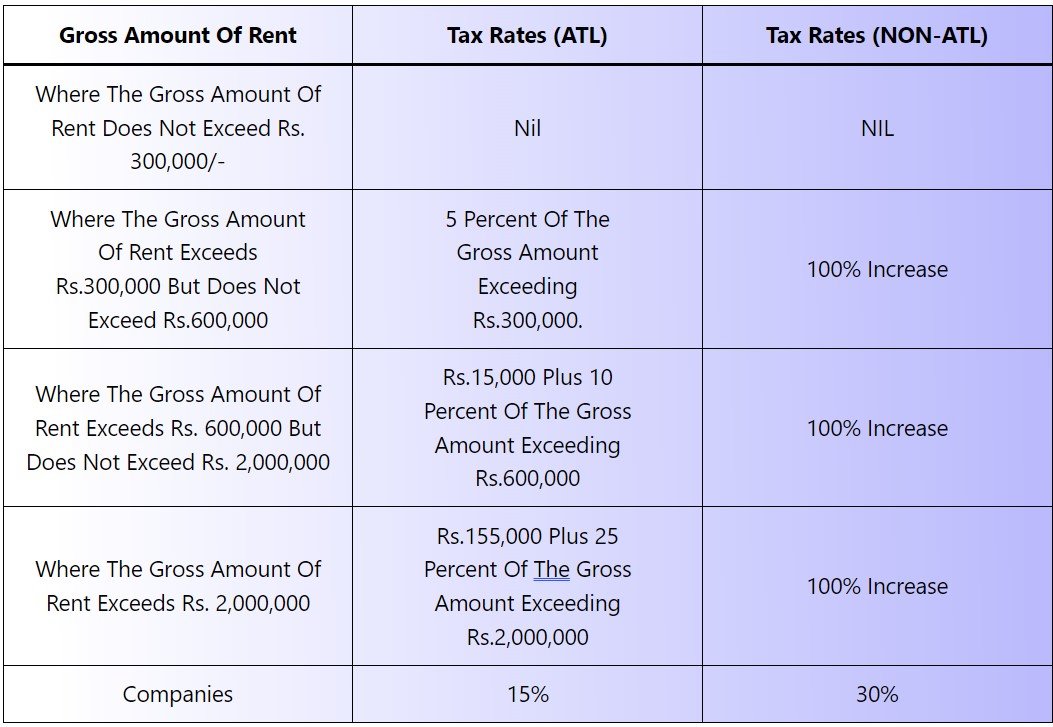

Following are the withholding tax rates on rental income from the immovable property on individuals and Association of persons(AOP):

| Gross Amount of Rent | Tax rates (ATL) | Tax rates (NON-ATL) |

|---|---|---|

| Where the gross amount of rent does not exceed Rs. 300,000/- | Nil | NIL |

| Where the gross amount of rent exceeds Rs.300,000 but does not exceed Rs.600,000 | 5 percent of the gross amount exceeding Rs.300,000. | 100% Increase |

| Where the Gross amount of rent exceeds Rs. 600,000 but does not exceed Rs. 2,000,000 | Rs.15,000 plus 10 percent of the gross amount exceeding Rs.600,000 | 100% Increase |

| Where the gross amount of rent exceeds Rs. 2,000,000 | Rs.155,000 plus 25 percent of the gross amount exceeding Rs.2,000,000 | 100% Increase |

Company: For a company, Tax rate shall be 15% (ATL) and 30% (NON-ATL).

For more guidance: https://www.fbr.gov.pk/Categ/Income-Tax-Ordinance/326