Definition of Straight-Line depreciation

Straight Line Depreciation method is widely used to calculate depreciation of fixed assets. In this method depreciation expense is evenly spread over the useful life of the fixed asset.

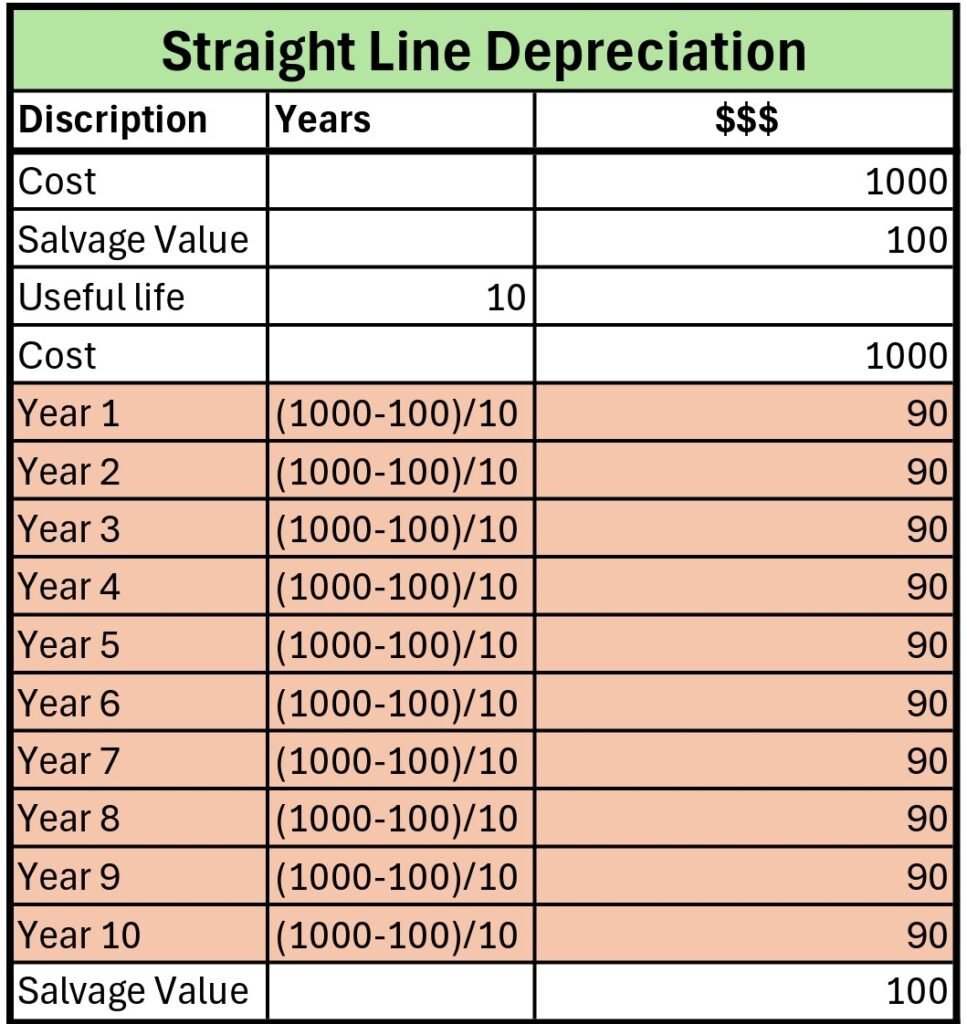

Formula

(Cost-salvage value) ÷ Useful life

Where:

Cost: It includes Invoice price and all other Capital Expenditure incurred on the Asset.

Salvage Value: Also known as residual value, it is the reaming value of an asset at the end of its useful life.

Useful life: It is life of an asset in the number of years for which asset is indented to use for driving economic benefits.

Example

Key features of Straight-Line Method

- Simple Calculation

- Even Distribution