Reducing balance depreciation Method and formula

Reducing balance method also known as declining balance method is based on the assumption that assets are depreciated rapidly in the initial years of their

Reducing balance method also known as declining balance method is based on the assumption that assets are depreciated rapidly in the initial years of their

Definition of Straight-Line depreciation Straight Line Depreciation method is widely used to calculate depreciation of fixed assets. In this method depreciation expense is evenly spread

Accounting is an art, but not an abstract one. Accounting is based on very accurate ideology of frameworks and concepts that all accountants must follow

Definition Revenue expenditures are costs incurred by a business to maintain its day-to-day operations. Every business has to spend a significant amount of money on

Capital expenditures are the costs incurred by the business in tangible and intangible assets for long-term benefits.

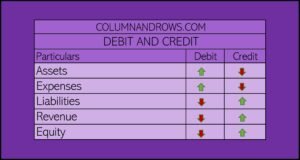

Debit and credit are accounting principles used to record business transactions in books and ledgers. All Accounting transactions are divided into five heads known Assets,

Bookkeeping involves recording monetary business transactions and maintaining accurate books of accounts of the business organization. Bookkeeping is basically writing business transactions in journals to

Accounting is the art of identifying, analyzing, classifying, recording, and presenting all monetary business transactions. Accounting provides a complex set of rules for all monetary

Two column cash book represents the Cash and the Bank column in the cash book records the amount of the transaction in the respective columns.

What is Account Receivable? Account Receivable keeps records of debtors of the business. All the money that the business is entitled to receive from its

Assets= Liabilities + Capital

Copyright © Accounting Heads | All Rights Reserved