Salary Income Tax Rates 2024-2025 in Pakistan | Tax year 2025

Finance Minister Muhammad Aurangzeb announced the Federal budget for 2024-2025 on June 10th, 2024. The Finance Act 2024 amended the withholding rules regarding the taxation

Finance Minister Muhammad Aurangzeb announced the Federal budget for 2024-2025 on June 10th, 2024. The Finance Act 2024 amended the withholding rules regarding the taxation

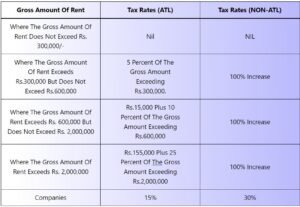

Rental Income It means any amount received or receivable by the owner of land or a building as consideration for the use or occupation of,

What is Super Tax under section 4C? 4C. Super tax on high earning persons: A super tax shall be imposed for tax year 2022 and

In the recently announced Finance Act, 2023 federal government made no changes in withholding tax rates on Rental Income Tax Rates 2023-2024. Rent It means

Finance Minister announced the Federal budget for 2023-2024 on May 9th, 2023. The Finance Act 2023 amended the withholding rules regarding the taxation of salaried

Income from the property: The rent received or receivable by a person for a tax year, other than rent exempt from tax under this Ordinance,

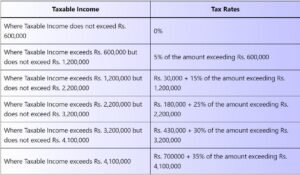

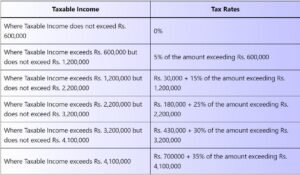

Taxable income Tax rates Where the taxable income does not exceed Rs. 600,000 The Tax rate is zero Where the taxable income exceeds Rs. 600,000

Assets= Liabilities + Capital

Copyright © Accounting Heads | All Rights Reserved