In the recently announced Finance Act, 2023 federal government made no changes in withholding tax rates on Rental Income Tax Rates 2023-2024.

Rent

It means any amount received or receivable by the owner of land or a building as consideration for the use or occupation of, or the right to use or occupy, the land or building, and includes any forfeited deposit paid under a contract for the sale of land or a building.

Income from Property

The rent received or receivable by a person for a tax year, other than rent exempt from tax under this Ordinance, shall be chargeable to tax in that year under the head Income from Property.

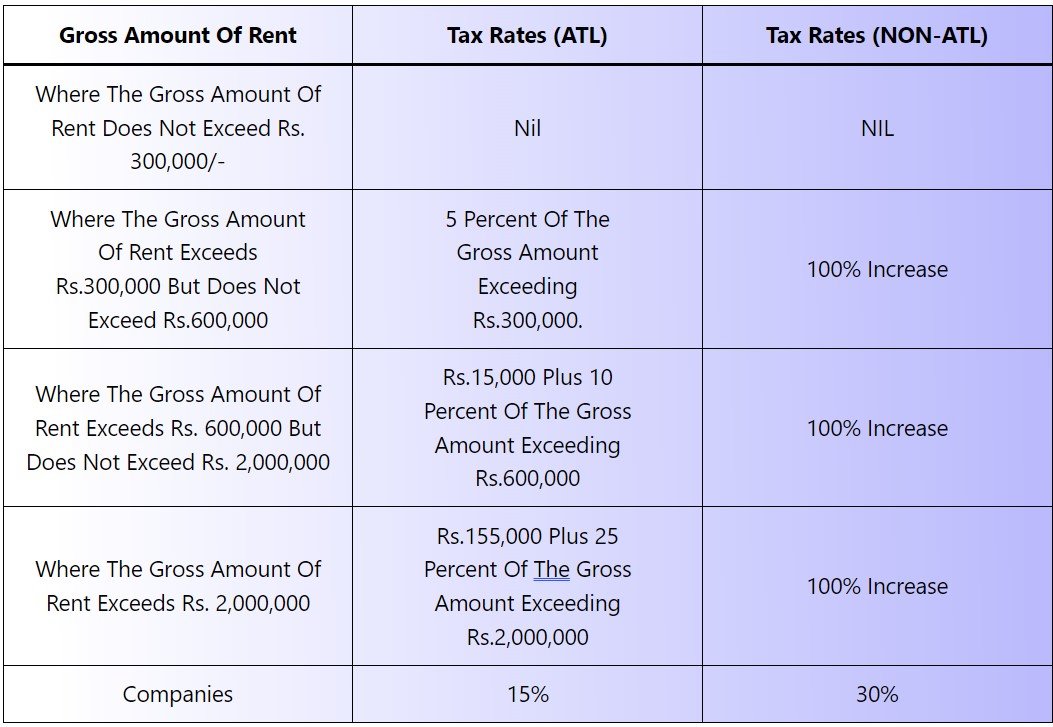

Withholding Tax Rates on Income from Property 2023-2024

| Gross Amount of Rent | Tax rates (ATL) | Tax rates (NON-ATL) |

|---|---|---|

| Where the gross amount of rent does not exceed Rs. 300,000/- | Nil | NIL |

| Where the gross amount of rent exceeds Rs.300,000 but does not exceed Rs.600,000 | 5 percent of the gross amount exceeding Rs.300,000. | 100% Increase |

| Where the Gross amount of rent exceeds Rs. 600,000 but does not exceed Rs. 2,000,000 | Rs.15,000 plus 10 percent of the gross amount exceeding Rs.600,000 | 100% Increase |

| Where the gross amount of rent exceeds Rs. 2,000,000 | Rs.155,000 plus 25 percent of the gross amount exceeding Rs.2,000,000 | 100% Increase |

For more guidance: https://www.fbr.gov.pk/Categ/Income-Tax-Ordinance/326