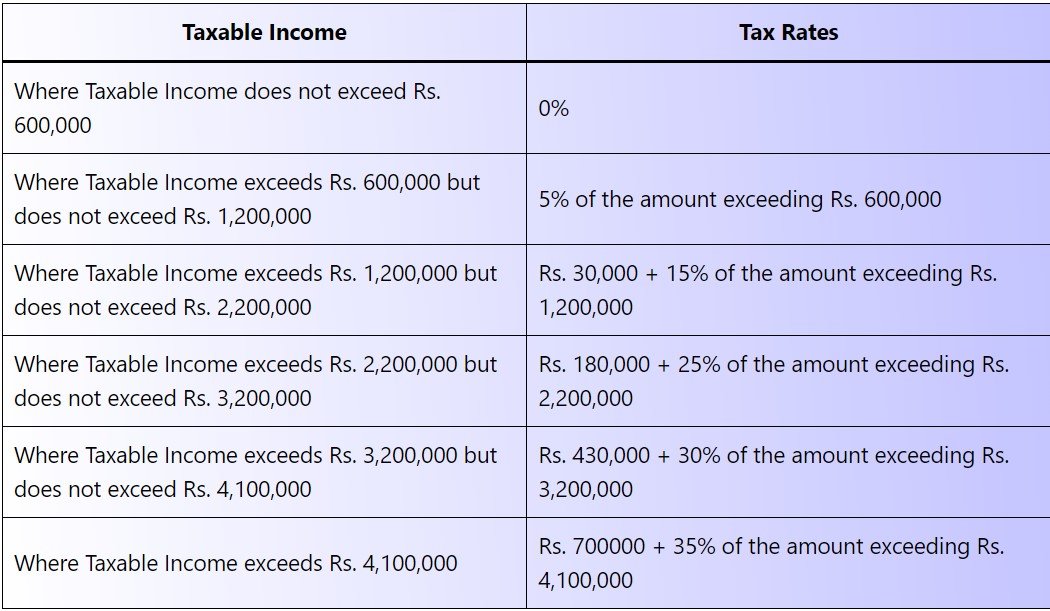

| Taxable income | Tax rates |

|---|---|

| Where the taxable income does not exceed Rs. 600,000 | The Tax rate is zero |

| Where the taxable income exceeds Rs. 600,000 but does not exceed Rs. 1,200,000 | 2.5% of the amount Exceeding Rs. 600,000 |

| Where the taxable income exceeds Rs. 1,200,000 but does not exceed Rs. 2,400,000 | Rs. 15,000 + 12.5% of the amount exceeding Rs. 12,00,000 |

| Where the taxable income exceeds Rs. 2,400,000 but does not exceed Rs. 3,600,000 | Rs. 165,000 + 20% of the amount exceeding Rs. 2,400,000 |

| Where the taxable income exceeds Rs. 3,600,000 but does not exceed Rs. 6,000,000 | Rs. 405,000 + 25% of the amount exceeding Rs. 3,600,000 |

| Where the taxable income exceeds Rs. 6,000,000 but does not exceed Rs. 12,000,000 | Rs. 1,005,000 + 32.5% of the amount exceeding Rs. 6,000,000 |

| Where the taxable income exceeds Rs. 12,000,000 | Rs. 2,955,000 + 35% of the amount exceeding Rs. 12,000,000 |

Here are salary Tax rates slab table for income tax on a person earning income under the head salary in Pakistan. These are applicable to the person whose taxable income is more than 75% of the income head salary in the Income Tax Ordinance, 2001 amended up to 30th June 2022. Some terms are defined below for a proper understanding of the Taxation system.

Salary: Salary means any amount received by an employee from any employment, whether of a revenue or capital nature. ( Income Tax Ordinance, 2001 )

Basic Salary: Amount received by an employee from the employer without including benefits, allowances, and perquisites.

Allowances: Additional benefits paid by the employer to the employee such as Medical Allowance, Conveyance allowence, House rent allowance, Utilities, and others.

Reimbursement: Amount spent by the employee but paid back by an employer including Medical Facility, TA/ DA, Salary of Domestic servants etc.

Related: